Indian Pharma Accelerates Growth in the Philippines

Indian pharmaceutical companies are making strong inroads into the Philippine healthcare market, driven by government-level trade talks, faster drug approvals, and upcoming local manufacturing zones. As both countries strengthen economic ties, India’s pharma sector is emerging as a key partner in improving access to affordable medicines in the Philippines.

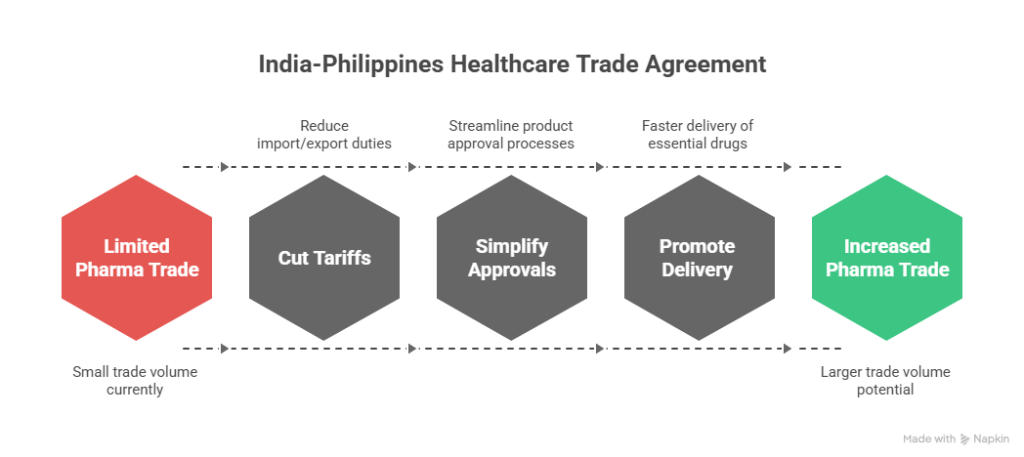

Governments Talk to Boost Trade

In August 2025, India’s Commerce and Industry Minister Piyush Goyal met with senior Philippine officials to explore deeper collaboration in healthcare trade.

Both sides acknowledged that current pharmaceutical trade between the two nations remains relatively small but full of potential. Talks centered around a Preferential Trade Agreement (PTA) that could:

If signed, the PTA would be a milestone, opening new doors for India’s $50 billion pharma export industry while supporting the Philippines’ push for affordable and accessible healthcare.

Key Drug Approvals Strengthen India’s Presence

One of the biggest recent wins came in October 2023, when Venus Remedies, a leading Indian pharmaceutical company, secured approval for six cancer drugs from Philippine regulators.

These include:

These approvals are not isolated. The Philippines has become one of the top ASEAN destinations for Indian medicines, with:

This shows growing confidence in Indian-made medicines, known globally for quality and affordability.

Push for Simplified Entry Rules

Despite strong trade interest, Indian firms still face bureaucratic barriers when registering new products in the Philippines. Industry representatives are urging the Philippine Food and Drug Administration (FDA) to:

Such measures could help medicines reach patients faster, especially in therapeutic areas like oncology, diabetes, and cardiovascular diseases — all major health concerns in the Philippines.

We hope that the political dynasties does not ruin this opportunity. As we have seen many time that the corrupt politicians makes investments and trade difficult for the country.

Plans for Local Production: The Rise of ‘Pharmazones’

To attract foreign investment, the Philippine government has unveiled plans for special Pharmaceutical Zones, or “Pharmazones”.

These zones will:

Indian contract manufacturers are already showing interest in these Pharmazones. Many are exploring partnerships to produce generics, vaccines, and active pharmaceutical ingredients (APIs) locally — reducing dependence on imports and improving supply chain stability.

| Focus Area | Opportunities for India | Benefits for the Philippines |

|---|---|---|

| Generics Production | Cost-effective large-scale manufacturing | Affordable local medicines |

| Vaccine Manufacturing | Advanced biotech capabilities | Better pandemic preparedness |

| Research & Development | Collaborative clinical studies | Stronger local innovation |

| Skill Training | Pharma education programs | Knowledge transfer & job creation |

These developments could lead to the Philippines becoming a key manufacturing hub for Indian pharma companies within Southeast Asia.

A Growing Market with Rising Health Needs

The Philippine pharmaceutical market is valued at around USD 2 billion (2025) and is growing at about 4% annually. This steady rise is driven by:

The most in-demand segments are:

India, known for its low-cost, high-quality generics, is perfectly positioned to fill these gaps. Many Indian firms are targeting the Philippines not just as a market, but as a regional gateway to ASEAN.

Healthcare Collaboration Beyond Trade

The partnership between India and the Philippines is evolving beyond pure commerce. Both countries are exploring:

Such initiatives aim to strengthen human capital and promote sustainable healthcare solutions in both nations.

Key Highlights

| Area of Progress | Details |

|---|---|

| Trade Agreement | PTA in discussion to cut tariffs and boost pharma exports |

| Recent Approvals | 6 cancer drugs by Venus Remedies (2023) |

| Regulatory Support | Push for faster FDA approvals for Indian medicines |

| Manufacturing Plans | India-Philippines joint ventures in Pharmazones |

| Market Size (2025) | USD 2 billion, growing 4% annually |

| Top Demand Segments | Generics, oncology, cardiovascular drugs |

Why This Partnership Matters?

Affordable access to medicine remains a key challenge in the Philippines, where many patients still struggle with high treatment costs. Indian companies bring a strong track record in producing cost-efficient medicines without compromising quality, aligning perfectly with the Philippine government’s healthcare goals.

Moreover, as the world looks for diversified supply chains post-pandemic, the Philippines can benefit from India’s expertise in pharmaceutical logistics, vaccine technology, and R&D.

The Road Ahead

If the ongoing Preferential Trade Agreement materializes, combined with faster approval systems and local manufacturing initiatives, India’s presence in the Philippine pharma sector is set to expand dramatically.

Industry experts predict that within the next five years:

These developments will not only strengthen trade but also enhance the overall healthcare ecosystem of the Philippines — making life-saving medicines more accessible and affordable.

In summary, The collaboration between India and the Philippines represents a model for South-South cooperation in healthcare. From trade talks to technology transfer, both countries are taking decisive steps toward a healthier, more self-reliant future.

As local factories rise, new drugs enter the market, and regulatory paths become smoother, Indian pharma is set to play a defining role in reshaping the Philippine health landscape — one affordable medicine at a time.